BTC Price Prediction: Path to $200,000 Analysis

#BTC

- Technical resistance at $118,800 needs to be broken for upward momentum to continue

- Federal Reserve rate cuts and institutional ETF adoption provide fundamental support

- Record accumulation address inflows indicate strong long-term holder confidence

BTC Price Prediction

Technical Analysis: BTC Approaches Key Resistance Level

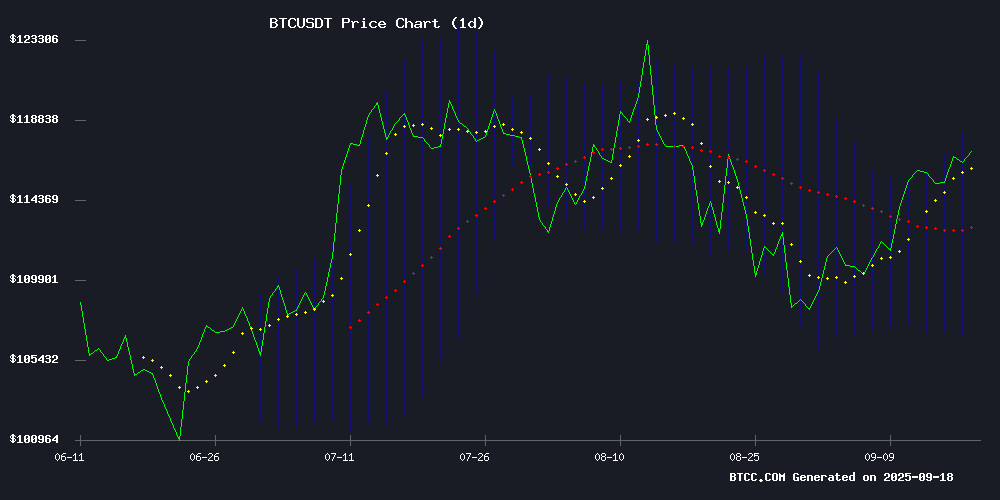

BTC is currently trading at $117,865, showing strength above the 20-day moving average of $112,934. The MACD remains negative at -2,953.68, indicating some bearish momentum, though the histogram shows potential convergence. Price is testing the upper Bollinger Band at $118,753, which serves as immediate resistance. According to BTCC financial analyst James, 'A sustained break above $118,800 could trigger the next leg higher toward $125,000.'

Market Sentiment: Bullish Catalysts Align for Bitcoin

Positive news flow supports BTC's upward momentum. The Fed's 25 bps rate cut, record inflows into accumulation addresses, and the launch of Poland's first Bitcoin ETF create a favorable backdrop. BTCC financial analyst James notes, 'While whale activity remains subdued, retail traders are anchoring prices near $117.5K. The combination of institutional adoption and monetary policy support suggests continued strength.' However, he cautions that corporate treasury demand shows signs of cooling, which may temper the rally's pace.

Factors Influencing BTC's Price

Retail Traders Anchor Bitcoin Near $117.5K as Whale Activity Remains Dormant

Bitcoin's stability around $117,500 reflects a retail-dominated market, with Binance data showing negligible whale participation. Transactions under 0.01 BTC accounted for over 816,000 BTC of inflows this week—a stark contrast to the absence of 100+ BTC movements.

This grassroots support creates a liquidity buffer against sudden sell-offs but introduces fragility. The market remains one large whale order away from volatility, as retail sentiment alone sustains current levels. CryptoQuant's metrics confirm the trend: 97,000 BTC flowed via 0-0.001 BTC transactions, while 719,000 BTC came from slightly larger 0.001-0.01 BTC transfers.

Trump Bitcoin Statue Unveiled at US Capitol Amid Fed Rate Cut

A 12-foot statue of former President Donald Trump holding a Bitcoin was temporarily installed outside the US Capitol, sparking discussions about digital currency and monetary policy. The installation, funded by Bitcoin advocates, coincided with the Federal Reserve's announcement of a quarter-point rate cut—the first since December 2024—to 4.1% amid slowing job growth.

The Fed signaled two additional cuts in 2025 but only one in 2026, falling short of market expectations. Organizers framed the statue as a symbol of the intersection between politics and financial innovation, aiming to provoke debate on cryptocurrency's role in reshaping government-issued currency.

Bitcoin Bulls Eye $118K Breakout as New All-Time High Looms

Bitcoin's resurgence toward $118,000 signals renewed bullish conviction, with analysts interpreting yesterday's Fed-driven pullback as a final shakeout before upward continuation. The cryptocurrency has demonstrated remarkable resilience, rebounding swiftly from a brief dip triggered by Jerome Powell's remarks and rate cut speculation.

Crypto VIP Signal identifies $118,000 as the critical threshold—a decisive breach could propel BTC toward $120,000 and beyond, cementing the ongoing bullish cycle. Market structure suggests accumulating buyers are using volatility as entry opportunities rather than exit signals.

Technical indicators including Bollinger Bands hint at growing momentum, though traders await confirmation of the $118K breakout. The market appears poised for either a decisive continuation pattern or another liquidity hunt before the next leg upward.

Polish Stock Exchange Launches Country's First Bitcoin ETF

The Warsaw Stock Exchange (WSE) has introduced Poland's inaugural bitcoin exchange-traded fund (ETF), marking a significant step toward broader cryptocurrency acceptance in the country's financial sector. The Bitcoin BETA ETF provides regulated exposure to Bitcoin, aligning with global trends of institutional crypto adoption.

The launch coincides with Poland's efforts to update its crypto asset regulations in compliance with EU standards. As Eastern Europe's largest stock exchange, WSE's move signals growing institutional confidence in digital assets. Michał Kobza, a member of WSE's management board, emphasized the product addresses rising investor demand for crypto-linked instruments.

With over 400 listed companies and nearly $600 billion in market capitalization, WSE's endorsement carries substantial weight in Central and Eastern European markets. The exchange already hosts 16 ETFs, but this marks its first venture into cryptocurrency-based products.

Bitcoin Price Soars Past $117,000 Following Fed’s 25 bps Rate Cut

Bitcoin surged past $117,000 as the Federal Reserve's 25 basis point rate cut injected Optimism into digital asset markets. While traditional equities wavered in volatile sessions, BTC held firm, buoyed by steady institutional inflows into crypto investment products.

ETF demand proved resilient despite macroeconomic uncertainty. Daily net flows remained positive throughout the week, only faltering briefly on September 17 ahead of the FOMC decision. Institutional conviction appears unshaken - a stark contrast to retail investors, whose participation has waned according to on-chain address metrics.

The divergence between Bitcoin and stock market performance underscores crypto's evolving role as an institutional asset class. Where traditional markets interpreted the rate cut as a warning signal, digital assets capitalized on looser monetary policy. This decoupling suggests growing maturity in Bitcoin's market dynamics.

Bitcoin Holds Above $117K Amid Diverging Market Signals

Bitcoin's rally continues as it closes above $117,000, defying mixed macroeconomic signals. The Federal Reserve's 25 basis point rate cut provides tailwinds, while long-term holders accumulate positions. Yet rising global liquidity—now at $128.1 trillion—threatens to divert capital toward traditional banks rather than risk assets.

Market data reveals a persistent inverse correlation between bank liquidity and BTC performance since 2022. With institutional accumulation paused and $30.4 trillion flowing into banking systems, Bitcoin's upside appears constrained despite technical strength. 'The tide lifts all boats—except when it doesn't,' observes one trader, noting crypto's atypical divergence from liquidity trends.

Best Crypto to Buy Now: Can DeepSnitch AI Do 100x in 2025?

Bitcoin ETF inflows surged to $2.3 billion between September 8 and September 12, marking a NEAR 10-week high. BlackRock's iShares Bitcoin Trust led with over $1 billion, followed by Fidelity's Wise Origin Bitcoin Fund at $850 million. This rebound coincides with Bitcoin's price climbing to $114,693, up 2.02% weekly.

Amid the market resurgence, new projects like DeepSnitch AI are gaining traction. Its presale has already delivered 10% returns, with speculation of parabolic growth. The AI-driven platform aims to empower retail traders with real-time decision-making tools.

Institutional demand for Bitcoin continues to strengthen, fueled by potential interest rate cuts. The crypto market's upward momentum appears poised to accelerate as capital flows return.

Bitcoin Accumulation Addresses Hit Record Inflows Ahead of Fed Rate Decision

Bitcoin's price action wavered under bearish pressure Wednesday as the market braced for the Federal Reserve's interest rate verdict. Despite short-term volatility, on-chain data reveals a surge in accumulation address inflows—a bullish signal from deep-pocketed investors.

CryptoQuant reports record BTC purchases by strategic holders, suggesting institutional positioning for macroeconomic turbulence. The buying spree precedes what could be a pivotal moment for risk assets, with traders anticipating heightened volatility.

Corporate Bitcoin Treasury Demand Shows Signs of Cooling in 2025

Corporate Bitcoin holdings reached a milestone 1 million BTC this year, yet the pace of accumulation has slowed markedly. Companies are now adopting a more measured approach, opting for smaller, incremental purchases rather than the aggressive accumulation seen during the peak of the corporate treasury rush.

MicroStrategy, rebranded as Strategy, remains the dominant player but its influence is waning. Its share of corporate Bitcoin holdings has dropped from 76% to 64% as other public companies increase their exposure. The firm's monthly purchases collapsed from 134,000 BTC in November 2024 to just 3,700 BTC by August 2025—a clear indicator of shifting sentiment.

Despite the slowdown, institutional activity remains significant. Corporations added more Bitcoin this year than all U.S. spot ETFs combined, demonstrating enduring conviction in the asset's long-term value. Strategy's unrealized gains stand at $27 billion on its 638,985 BTC holdings, acquired at an average cost basis of $73,913 per coin.

Market analysts attribute the caution to macroeconomic uncertainty. CryptoQuant data reveals that while the number of purchase transactions hit record highs, the actual volume of Bitcoin acquired has declined sharply. The research firm noted 840,000 BTC held in corporate treasuries by early September, with firms executing smaller, more frequent transactions—a pattern suggesting weakening institutional demand beneath the surface of headline numbers.

Bitcoin Difficulty Set for Sixth Consecutive Increase, Poised to Break Record

Bitcoin's mining difficulty is on track for its sixth straight increase, with a projected 4.9% jump in the upcoming adjustment. This adjustment, expected on Thursday, will push the metric to a new all-time high of 142.7 trillion.

The difficulty mechanism ensures block production remains near the 10-minute target. Recent blocks have averaged 9.53 minutes, prompting the upward recalibration. Such consistent increases underscore growing miner commitment despite market volatility.

Network fundamentals continue strengthening as hash rate follows difficulty upward. The self-correcting algorithm demonstrates Bitcoin's resilience, maintaining equilibrium regardless of miner participation fluctuations.

Bitcoin Stochastic RSI Signals Potential Rally as Key Resistance Looms

Bitcoin's weekly Stochastic RSI has crossed into bullish territory, historically a reliable precursor to upward momentum. The September 8 crossover at $117,600 mirrors similar technical patterns in September 2023, January 2024, and March 2025—each followed by sustained price appreciation.

The cryptocurrency now faces a critical test at the $119,000-$119,500 resistance zone. A decisive breakout could propel BTC toward $123,000, while rejection risks a retest of support near $111,900. Market observers note the current cycle's extended trajectory, with peak projections now stretching into early 2026.

Institutional participation continues reshaping Bitcoin's market structure, potentially altering traditional cycle timelines. As analyst Ash Crypto noted, the Stochastic RSI crossover has consistently marked oversold conditions before significant rallies—a pattern now under scrutiny as BTC challenges multi-month resistance.

Will BTC Price Hit 200000?

Based on current technicals and market conditions, reaching $200,000 is possible but would require sustained momentum and additional catalysts. BTC would need to gain approximately 70% from current levels. Key factors include:

| Target | Required Gain | Key Levels |

|---|---|---|

| $125,000 | +6% | Break above Bollinger upper band |

| $150,000 | +27% | Previous ATH consolidation |

| $200,000 | +70% | Macro adoption acceleration |

BTCC financial analyst James suggests: 'While $200,000 is achievable in the current cycle, it would likely require continued institutional adoption, favorable regulatory developments, and sustained momentum above $120,000. The sixth consecutive difficulty increase indicates strong network fundamentals supporting long-term appreciation.'